The illegitimate credits initially cost the state $131,000 in fraudulent income tax refunds, which the Louisiana Department of Revenue recovered through the collection process.īlockson pleaded guilty to Filing False Public Records. None of the taxpayers involved were aware of Blockson’s scheme. According to the charging document, Blockson improperly claimed the credits of behalf of hundreds of clients by falsely identifying them as day care center operators. 2019 for a tax fraud scheme involving state child care tax credits. “LDR is committed to preserving the funds available to those who qualify for this program and continues its investigation into disaster related fraud,” said Secretary of Revenue Kevin Richard.Ĭourt bars Monroe man from working as a tax preparer in Louisiana.Continue ReadingīATON ROUGE – A Monroe man who pleaded guilty to a tax fraud-related felony is barred permanently from working as a tax preparer in Louisiana.Ĭourtney C.

Check my stimulus status for free#

LDR wants the citizens of Louisiana to know that the Natural Disaster Claim form is available for free on its website,. The company’s clients told investigators they had not provided the information that was submitted on their behalf.Ĭarbo, Ricard and Williams were booked into the East Baton Rouge Parish Prison on charges of Injuring Public Records, which can result in a sentence of up to five years and fines of up to $5,000. Investigators with the Louisiana Department of Revenue (LDR) say the three women, working for Global Tax Service, charged clients as much as $110 to prepare and submit the sales tax refund form using false information and inflating the value of the losses.

Starr Carbo, Johnnie Mae Ricard and Erica Williams, all of Westwego, are charged in connection with fraudulently preparing and submitting Natural Disaster Claim for Refund of State Sales Taxes Paid forms following Hurricane Ida in 2021.

IMPORTANT: After your search, if the message you receive indicates that you are eligible for a stimulus payment but the Comptroller's Office is unable to validate your mailing address on file, you MUST contact the Comptroller's Office to provide an updated mailing address.BATON ROUGE – Three Louisiana residents face felony charges after allegedly defrauding a state program that offers sales tax refunds on personal property destroyed in a natural disaster.īased on a Presidential declaration, citizens can apply for a refund of sales tax they paid on items lost during a declared disaster. No further action is required for recipients with a valid bank account or valid mailing address. The amount your will receive from a 2nd Stimulus Check begins to decrease for individuals and married couples at a rate of 5 for every 100 in income over the threshold until being phased out entirely at 87,000 for individuals, 124,500 for heads of household, and 174,000 for married couples filing jointly. If you do not have a validated bank account but have a valid mailing address that has been verified by the United States Postal Service, you will be mailed a paper check. Postal Service, your payment will be electronically transmitted. If you have a validated bank account number on file from your Tax Year 2019 Maryland State Tax Return and a mailing address that has been verified by the U.S.

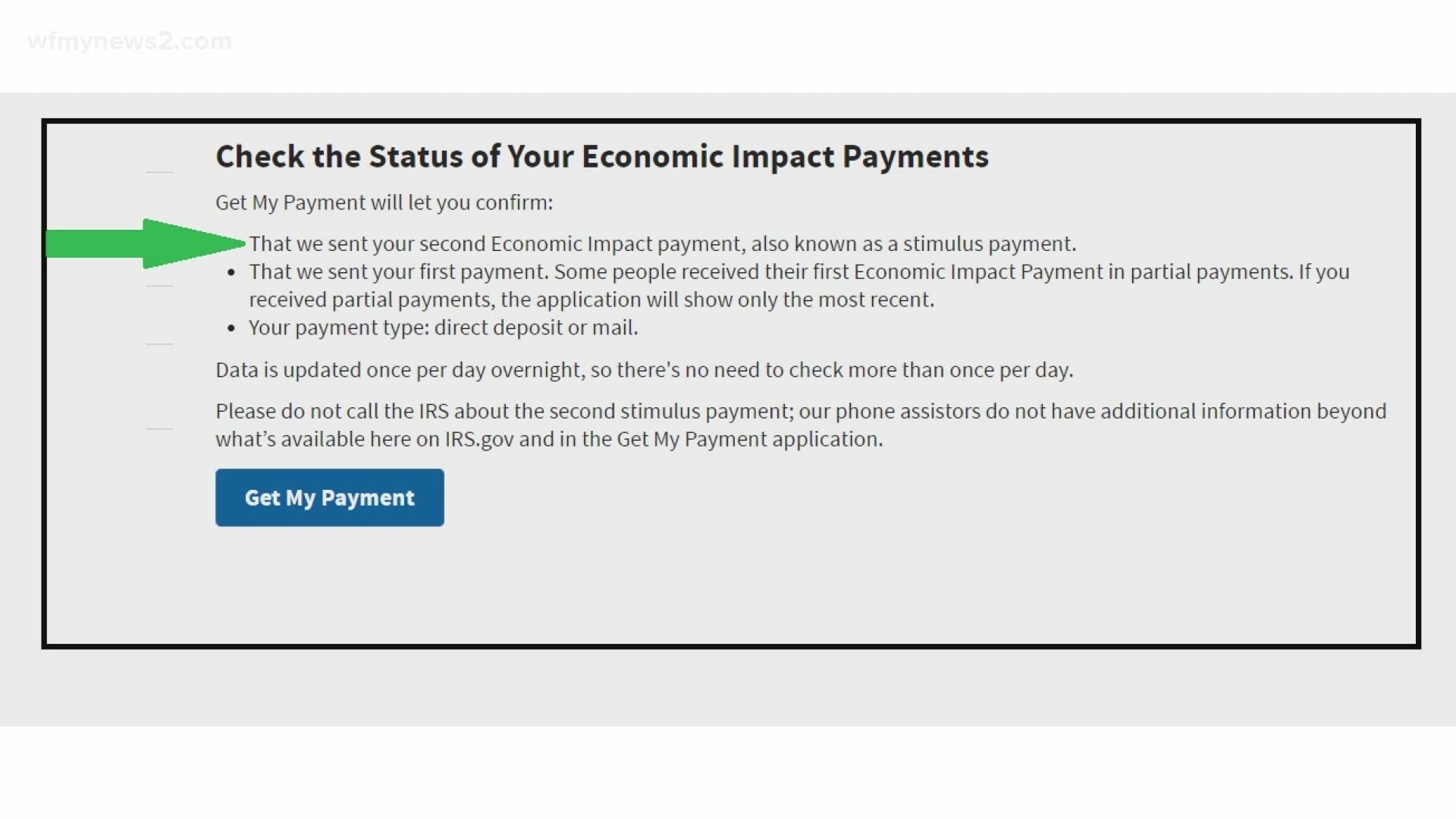

The Comptroller's Office will begin processing RELIEF Act payments to eligible recipients on February 16, 2021. If you are eligible for a stimulus payment, you will be able to check the status of your payment. The size of your stimulus check is based on your adjusted.

Check my stimulus status drivers#

Please remember, you will need your Alaska Drivers License or ID to view your information. Qualifying couples will receive 1,200 and qualifying dependents get 600. Check your Application Status by selecting myPFD. To check your eligibility for a RELIEF Act stimulus payment, enter the information below. Right now, stimulus checks for qualifying individuals are 600.

0 kommentar(er)

0 kommentar(er)